To avoid costly competition, firms can innovate or expand in the hope of finding a blue ocean. A blue ocean exists where no firms currently operate, leaving the company to expand without competition.

Monday, July 26, 2010

What is Blue ocean Strategy?

To avoid costly competition, firms can innovate or expand in the hope of finding a blue ocean. A blue ocean exists where no firms currently operate, leaving the company to expand without competition.

Thursday, July 22, 2010

What Is Angel Investing?

(Click on the Image to enlarge it)

Tuesday, July 13, 2010

What Is Washroom Marketing?

It sounds weird but it’s true.

As the name suggests, it’s advertising in the washroom, literally. Something like putting the advertisement and pamphlet about a product in the loo.

This is a place our eyes can never miss, 9 out of 10 times its gender specific, and when you are in the loo, you might as well read it.

Most of us have taken newspapers to the loo, which in fact is filled with ads. There have been questions about the privacy issues in the washroom, but one can’t figure out how privacy comes into picture here. There is no camera there in the washroom, unless and until the advertisement is hiding a cam under it.

Just placing something to read there doesn’t lead to invasion of privacy. Moreover it’s a sure shot method of reaching the customer. He/she will read it without any disturbance. And yes for everyone’s information there are companies too for washroom marketing like Positive Media of UK, IN YOUR FACE media corp. and many others. The marketing communication world is getting weirder by the day…

Sunday, July 11, 2010

What are PODs and POPs? (Marketing)

(Points Of Parity)

(Points Of Parity) (Points Of Difference)

(Points Of Difference)Points-of-difference (PODs) – Attributes or benefits consumers strongly associate with a brand, positively evaluate and believe they could not find to the same extent with a competing brand i.e. points where you are claiming superiority or exclusiveness over other products in the category.

In a crowded market place, products that stand out and get noticed.

"Point of Difference" = a difference that competitors do not have have in their product or Brand.

The assessment of consumer desirability criteria for PODs should be against:

Relevance

Distinctiveness

Believability

Points-of-parity (POPs) – Associations that are not necessarily unique to the brand but may be shared by other brands i.e. where you can at least match the competitors claimed benefits. While POPs may usually not be the reason to choose a brand, their absence can certainly be a reason to drop a brand.

Whilst when assessing the deliverability criteria for POPs look at their:

Feasibility

Communicability

Sustainability

Friday, July 9, 2010

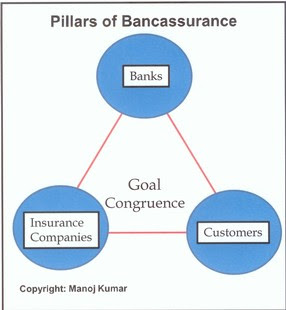

What Is Bancassurance?

The Bank Insurance Model ('BIM'), also sometimes known as 'Bancassurance', is the term used to describe the partnership or relationship between a bank and an insurance company whereby the insurance company uses the bank sales channel in order to sell insurance products.

BIM allows the insurance company to maintain smaller direct sales teams as their products are sold through the bank to bank customers by bank staff.

Bank staff and tellers, rather than an insurance salesperson, become the point of sale/point of contact for the customer. Bank staff are advised and supported by the insurance company through product information, marketing campaigns and sales training.

Both the bank and insurance company share the commission. Insurance policies are processed and administered by the insurance company.

BIM differs from 'Classic' or Traditional Insurance Model (TIM) in that TIM insurance companies tend to have larger insurance sales teams and generally work with brokers and third party agents.

An additional approach, the Hybrid Insurance Model (HIM), is a mix between BIM and TIM. HIM insurance companies may have a sales force, may use brokers and agents and may have a partnership with a bank.

BIM is extremely popular in European countries such as Spain, France and Austria.

The usage of the term picked up as banks and insurance companies merged and banks sought to provide insurance, especially in markets that have been liberalised recently. It is a controversial idea, and many feel it gives banks too great a control over the financial industry or creates too much competition with existing insurers.

In some countries, bank insurance is still largely prohibited, but it was recently legalized in countries such as the United States, when the Glass-Steagall Act was repealed after the passage of the Gramm-Leach-Bliley Act. But revenues have been modest and flat in recent years, and most insurance sales in U.S. banks are for mortgage insurance, life insurance or property insurance related to loans. But China recently allowed banks to buy insurers and vice versa, stimulating the bancassurance product, and some major global insurers in China have seen the bancassurance product greatly expand sales to individuals across several product lines.

Source - Wickipedia.com

Image Source - einsuranceprofessional.com

Thursday, July 8, 2010

What Is Volcker Rule?

(Click on the image to enlarge)

(Click on the image to enlarge)The Volcker Rule (also known as the "Volcker Plan") is a proposal by American economist and former Federal Reserve Chairman Paul Volcker to restrict banks from making certain kinds of speculative investments if they are not on behalf of their customers. Volcker has argued that such speculative activity played a key role in the financial crisis of 2007–2010. Volcker was earlier appointed by Obama as the chair of US President Barack Obama's Economic Recovery Advisory Board, a board created on February 6, 2009.

Basically it is the trading restrictions placed on financial institutions. The Volcker rule separates investment banking, private equity and proprietary trading (hedge fund) sections of financial institutions from their consumer lending arms.

Banks are not allowed to simultaneously enter into an advisory and creditor role with clients, such as with private equity firms. The Volcker rule aims to minimize conflicts of interest between banks and their clients through separating the various types of business practices financial institutions engage in.

The rule was introduced following the recession of 2008, to control the risk associated with the financial sector. Wall Street banks were accused of accumulating an excessive amount of risk and unfair business practices due to the inability of regulators to properly monitor their complex instruments and activities. The Volcker rule aims to protect individuals by creating a more transparent financial framework which can be regulated with greater ease.

Source - Investopedia.com

Image Source - nakedcapitalism.com

A Fresh New Start...

In this competitive world and busy schedule it is very tough to stay updated with the information, many of us find it difficult to understand the fundas of Finance and Marketing as we don’t know the event or funda in detail.

Thus I have created a blog to share New Ideas and Information which will let us know the things from the roots and making our life simpler in understanding the Finance and Marketing Jargons and cracking the story behind them.

Kindly add yourself in the follower list of the blog and stay updated with a new article daily. Once you join the blog as a follower your will receive the updates.

Visit the Blog on the below mentioned link